Data trust for financial services: The importance of accuracy and security

The financial industry runs on data — from processing transactions and verifying customer details to generating reports for regulators. But as the volume and complexity of data grow, so do the risks.

Cyber threats are more sophisticated, regulations keep evolving, and customers expect faster, more personalized service.

The takeaway? Financial institutions must be able to trust their data.

In this guide, we cover:

- What data trust means in financial services

- Why it’s more critical than ever

- How AI and master data management (MDM) help

- Best practices to build lasting trust in data

What is data trust in financial services?

Data trust is the confidence that your data is accurate, secure, reliable, and compliant with regulations. In finance, this trust is mission-critical: every process depends on it: from opening an account to risk assessment. If data is wrong, outdated, or inconsistent, the impact can be costly.

Core elements of trustworthy data:

| Element | Why it matters in finance |

|---|---|

| Accuracy | Reflects real-world facts, like a customer’s balance or a market change. |

| Consistency | Same across all systems — no conflicting versions of “the truth.” |

| Security | Protects sensitive info from breaches or unauthorized access. |

| Transparency | Tracks origin, changes, and usage history. |

| Accessibility | Ensures the right people can access the right data at the right time. |

Without these, banks and financial firms risk:

- Regulatory penalties

- Damaged customer relationships

- Poor decision-making

Why financial institutions must prioritize data trust

1. Rising cybersecurity threats and fraud

Financial services are prime targets for cyberattacks. In 2024, breach attempts surged, many involving stolen personal data or fraudulent transactions. Weak controls on data quality and access make these attacks harder to detect and stop.

2. Increasing regulatory complexity

Laws like GDPR, CCPA, Basel III, and SOX demand rigorous oversight of how data is collected, stored, and shared. Noncompliance can mean:

- Heavy fines

- Loss of customer trust

- Exclusion from key markets

3. Operational inefficiencies and decision risk

If teams can’t trust their data:

- Duplicate records delay transactions

- Outdated info triggers complaints

- Conflicting data fuels poor credit or investment decisions

Strengthening data trust with AI and MDM

Master data management (MDM): Your single source of truth

MDM consolidates data from multiple systems into a consistent, unified view.

Benefits for financial services:

- Eliminates duplicate/conflicting records

- Keeps customer/account data in sync

- Updates in real time to support fraud detection and quick responses

MDM is particularly valuable for institutions with siloed systems or post-merger complexity.

AI-powered data integrity

AI enhances data trust by finding and fixing problems faster than manual checks.

AI use cases in finance:

- Anomaly detection: Spot unusual spending or transaction patterns instantly

- Data cleansing & validation: Fix formatting issues or inconsistent entries automatically

- Compliance monitoring: Flag regulatory concerns before they escalate

Best practices for building data trust in finance

| Step | Action | Why it matters |

|---|---|---|

| 1 | Implement strong data governance | Defines ownership, usage rules, and consistency. |

| 2 | Monitor data quality continuously | Detects duplicates, missing values, or anomalies early. |

| 3 | Ensure data lineage & transparency | Helps trace and troubleshoot data issues fast. |

| 4 | Enforce security with access controls & encryption | Protects sensitive information from misuse. |

| 5 | Explore emerging tech like blockchain | Adds security and transparency for transactions. |

FAQ: Data trust in financial services

Q: What’s the difference between data trust and data quality?

A: Data quality is about the condition of your data (accuracy, completeness). Data trust also includes security, compliance, and transparency.

Q: Can small financial firms benefit from MDM and AI?

A: Yes — these tools scale to fit organizational size and can significantly reduce risk.

Q: How often should data quality be checked?

A: Continuously, with automated monitoring for real-time detection.

The bottom line: Data trust is the foundation for innovation

Financial institutions face unprecedented pressure to:

- Operate faster

- Serve customers better

- Stay ahead of new risks

None of this is possible without trustworthy data.

Getting it right means:

- Fewer errors

- Stronger compliance

- Better strategic decisions

With a solid data governance framework, technologies like MDM and AI, and a long-term vision, financial institutions can not only protect themselves today but also unlock opportunities for future innovation.

Next Steps:

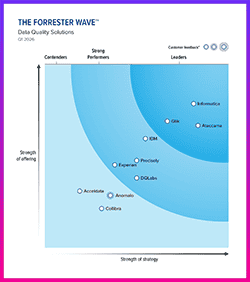

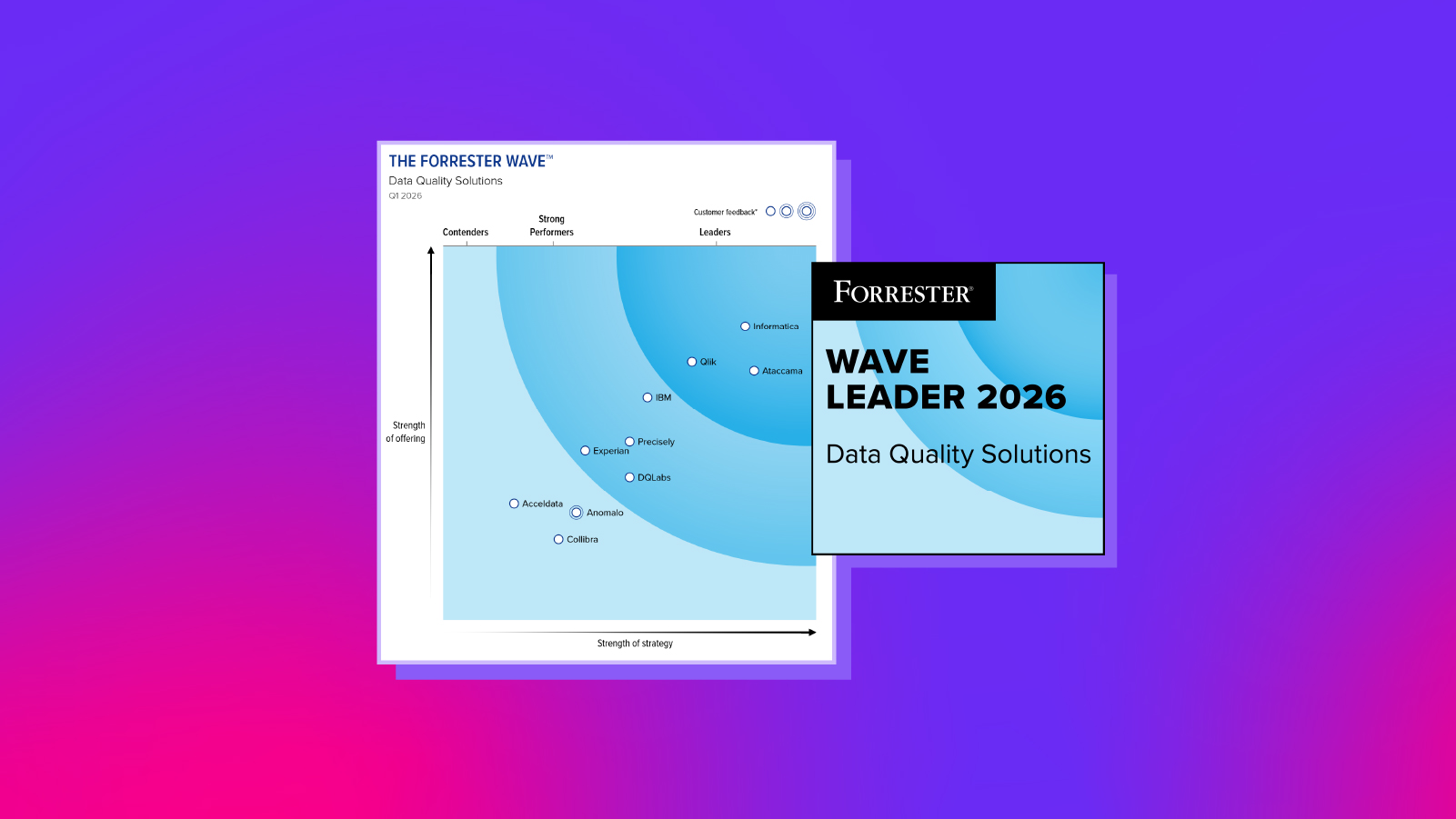

Start by assessing how well your current systems support data trust. Are there gaps in data quality, consistency, or oversight? Explore how a platform like Ataccama can help close those gaps and strengthen your foundation.

Visit Ataccama’s Data Trust Experience to learn more.

David Lazar

David is the Head of Digital Marketing at Ataccama, bringing eight years of experience in the data industry, including his time at Instarea, a data monetization company within the Adastra Group. He holds an MSc. from the University of Glasgow and is passionate about technology and helping businesses unlock the full potential of their data.