Data trust in insurance: Building confidence in the digital age

These days, everything runs on data—especially in insurance. But if that data can’t be trusted, things quickly fall apart. Mistakes pile up, rules are harder to follow, and customers lose confidence. That’s why data trust in insurance isn’t just a nice to have—it’s essential.

Whether you’re trying to improve how your team works, stay on top of regulations, or simply show customers you handle their information with care, building trust in your data is the place to start.

In this post, we’ll explain what data trust for insurance is all about, why it’s important, the common roadblocks insurers face, and how you can build stronger data practices for the future.

What is data trust for insurance services?

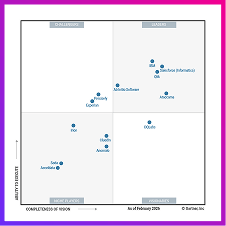

Data trust for insurance services refers to the confidence stakeholders have in the accuracy, consistency, security, and transparency of the data used across the insurance value chain. It means you can rely on the data to make decisions, stay compliant, and keep your customers happy. In 2025 and beyond, this concept is evolving fast thanks to AI advancements. Check out this report on AI and data trust to see where things are heading.

Why is data trust for insurance important?

Here’s why data trust in insurance matters now more than ever:

- Operational efficiency: Clean, accurate data reduces redundancies and manual interventions. Processes become faster and cheaper.

- Risk management: Better data = better predictions. You can price policies more accurately and reduce fraud.

- Regulatory compliance: Whether it’s GDPR, CCPA, or another regulation, trustworthy data helps ensure you’re on the right side of the law.

- Customer confidence: When clients know their data is safe and handled transparently, trust—and retention—go up.

What are the key challenges of establishing data trust in the insurance industry?

Building data trust isn’t without hurdles. Here are a few common ones—and why they matter:

- Data silos: When customer and operational data are stuck in disconnected systems, inconsistencies creep in and decision-making suffers.

- Legacy systems: Older platforms weren’t built for today’s data needs, making insurance data integration a serious challenge.

- Cybersecurity threats: Insurers are prime targets for data breaches. Without strong insurance data security, trust evaporates.

- Regulatory complexity: With ever-changing global and local laws, staying compliant requires effort and constant monitoring.

What are the key pillars of data trust?

To create a sustainable framework for data trust in insurance, these five pillars are essential:

Data quality

Good decisions start with good data. High-quality data is consistent, accurate, complete, and timely. It supports everything from underwriting to claims processing. Learn more about the importance of data quality.

Data governance

A solid data governance framework helps define ownership, policies, and procedures around data usage, ensuring clarity and accountability.

Data security

Your customers trust you with their most personal information. Encrypt it. Protect it. Audit it. Insurance data security is non-negotiable.

Data transparency

Transparency builds trust. Customers and regulators alike expect clear insight into how data is collected, stored, and used. Data transparency in insurance can set you apart.

Data integration

In a world of multiple platforms and apps, seamless data integration ensures consistency across departments and systems—enabling reliable analytics and reporting.

How to build and maintain data trust in the insurance industry

So, how do you put all this into action? Here’s how insurers can build—and keep—data trust at the core of their operations:

1. Implement master data management (MDM)

Create a single, unified view of your key data entities (like customers or policies) using MDM. This improves accuracy, eliminates duplicates, and ensures consistent reporting. Read more about master data management.

2. Adopt data governance frameworks

Clearly define who owns what data, how it’s used, and the rules around it. This minimizes confusion, mitigates risk, and strengthens your insurance data compliance efforts.

3. Invest in data quality tools

Use intelligent solutions that continuously monitor and cleanse your data. It’s one of the best ways to ensure your analytics and AI models work with trustworthy inputs. See how to invest in data quality tools.

4. Enhance data security measures

Encryption, access controls, and regular audits help you stay ahead of threats. Prioritize insurance data security at every level of your organization.

5. Leverage advanced technologies

AI and machine learning can detect anomalies, predict customer behavior, and automate data management tasks—pushing you ahead of the competition. Explore how to boost trust with AI and machine learning.

Next step: See Ataccama’s Data Trust Experience

Data trust isn’t just a tech goal—it’s a business one. It’s the key to insurance data governance, customer trust, smarter AI adoption, and staying compliant in an increasingly regulated world. Want to see how it all comes together? Explore the Data Trust Experience.