Data compliance regulations in 2025: What you need to know

In 2025, data compliance rules are getting stricter across the board. Whether you’re in finance, insurance, or manufacturing, it’s important to stay on top of these changes to protect sensitive data. With regulations constantly evolving, having solid data governance in place is a must. It helps make sure your data is handled correctly, keeps you out of trouble, and helps maintain trust with everyone involved. In this article, we’ll explain what data compliance is, why it matters, and the key regulations you need to know about in 2025.

What is data compliance?

Data compliance is the process of ensuring that data collection, handling, storage, sharing, and deletion align with applicable laws, regulations, industry standards, and internal policies. It implements controls to protect sensitive information, prevent misuse and breaches, maintain customer trust, and avoid penalties, covering the entire data lifecycle from creation through retention and disposal.

Key aspects of data compliance

- Adherence to rules: GDPR, CCPA, HIPAA, SOX, PCI DSS, and internal policies.

- Lifecycle coverage: Collection → use → storage → sharing → retention/disposal.

- Protection of personal & sensitive data: Access controls, encryption, monitoring.

- Prevention of penalties & risk: Audits, evidence, breach response.

- Trust & accountability: Transparent practices and documented ownership.

For a deeper look into data governance and how it supports compliance, check out our Data Governance Framework.

Data governance regulations

Data governance regulations are the laws and policy standards that direct how organizations collect, use, protect, and provide access to data. They require a documented governance framework with clear policies, data-quality rules, security controls, and access management. Examples include GDPR and CCPA for privacy, HIPAA for health data, PCI-DSS for cardholder data, and the EU Data Governance Act.

Key regulations and concepts

- GDPR/CCPA: Consent, data rights, breach notice, accountability.

- HIPAA: Safeguards for protected health information.

- PCI-DSS: Technical and process controls for card data.

- EU Data Governance Act: Reuse and sharing of public-sector and certain protected data with strong safeguards.

- Core governance practices: Policies, stewardship, data quality, access control, auditability.

Why is data compliance important for organizations moving into 2025?

As we move into 2025, data compliance is more important than ever for managing risk and keeping things running smoothly. With privacy laws like GDPR and CCPA in play, businesses have to stay compliant to avoid big fines and damage to their reputation. Plus, following the rules helps build trust with customers and stakeholders, showing that you’re serious about protecting sensitive data.

Since these regulations are always changing, companies need to be flexible and stay on top of their data management practices. Embracing data compliance doesn’t just keep you legally safe—it can also boost efficiency and lower the chances of data breaches.

What is the difference between data security and data compliance?

Data compliance is all about following the rules and regulations for handling data, while data security compliance is more focused on keeping that data safe from things like unauthorized access or breaches. To put it simply, data compliance covers the “how” of managing data, and data security compliance makes sure those rules are followed securely.

Data compliance regulations and standards: 5 key types

Let’s take a look at five key data compliance regulations and standards that every organization should know about.

1. Health Insurance Portability and Accountability Act (HIPAA)

HIPAA sets standards for protecting sensitive patient information in the healthcare industry. It ensures that healthcare providers, insurers, and their business partners safeguard patient data, including electronic health records (EHRs).

2. General Data Protection Regulation (GDPR)

The GDPR governs how organizations collect, store, and process personal data in the European Union. It places strict guidelines on obtaining user consent, data subject rights, and accountability for data breaches.

3. The Sarbanes-Oxley Act (SOX)

SOX is a U.S. regulation designed to protect shareholders and the public from accounting errors and fraud in enterprises. It affects data compliance, particularly regarding financial data accuracy, transparency, and reporting.

4. Payment Card Industry Data Security Standards (PCI-DSS)

PCI-DSS outlines security measures for organizations that handle credit card information. It aims to prevent fraud and data breaches in the payment processing industry.

5. California Consumer Privacy Act (CCPA)

The CCPA provides California residents with more control over their personal data, including rights to access, delete, and opt-out of the sale of their information. It has become one of the most influential data privacy laws in the U.S.

The impact of data compliance in 2025 by industry

Financial data compliance

Financial data compliance is adherence to laws and controls that protect customer information, ensure market integrity, and prevent fraud and money laundering. In practice, it means governing how financial data is collected, stored, accessed, and reported in line with regulations such as GDPR/CCPA (privacy), SOX (financial reporting), GLBA (consumer financial data), and BSA/AML (anti-money-laundering).

Financial services

The financial services industry has to deal with a bunch of data compliance rules, like GDPR, CCPA, and PCI DSS. With so much sensitive data to manage and secure transactions to handle, it can be a real challenge. That’s where strong data governance comes in—helping financial institutions automate compliance reporting, keep data intact, and reduce the risks during audits.

Insurance

Insurance companies have to stick to NAIC regulations, privacy laws, and data retention rules. Data governance tools make it easier to manage policies, improve data accuracy, and help companies stay on top of changing compliance standards in a constantly evolving regulatory landscape.

Manufacturing

For manufacturers, following standards like ISO 27001 and GDPR is key to handling sensitive supply chain and production data. Data governance makes sure the data stays secure, accurate, and compliant, helping manufacturers streamline processes while staying on top of industry regulations.

What is data compliance management?

Data compliance management is the ongoing program that oversees policies, procedures, and controls so data collection, use, storage, sharing, and disposal conform to laws, industry standards, and internal policies. It coordinates access control, encryption, consent management, training, audits, incident response, and documentation to protect sensitive information, prove compliance during audits, and reduce legal and security risk across the data lifecycle.

Core activities

- Adherence to regulations: GDPR, CCPA, HIPAA, SOX, PCI DSS.

- Security controls: Access management, encryption, monitoring, logging.

- Privacy & consent: Data minimization, purpose limits, consent records.

- Training & ownership: Roles, stewardship, recurring enablement.

- Audits & evidence: Policies, DPIAs, records, and third-party risk.

- Incident response: Tested playbooks and post-incident reviews.

- Documentation: Data inventory, retention, and disposal.

How to ensure proper data compliance regulations in your organization: 7 steps

To ensure your organization is compliant with data regulations, follow these seven key steps:

- Identify the Data Compliance Regulations for Your Industry Understand the specific regulations that apply to your sector, such as HIPAA for healthcare or PCI DSS for financial transactions.

- Establish a Data Inventory Document all data assets to know exactly where sensitive data is stored and how it’s used.

- Control Data Accessibility Limit data access to only those who need it, ensuring that sensitive information is securely managed.

- Enable Storage and Security Measures Implement encryption and secure storage solutions to protect sensitive data from breaches.

- Get Buy-In from Necessary Stakeholders Ensure your team is on board and trained to understand compliance protocols.

- Create Clear Company Policies on Data Compliance Develop comprehensive internal policies and a data breach response plan to guide data handling and breach management.

- Conduct Regular Audits and Data Monitoring Regular audits help ensure compliance and allow for early identification of any risks or vulnerabilities.

For more information on data quality monitoring, check out our guide to data quality monitoring.

Data compliance FAQ

- What is the Data Protection Act? The Data Protection Act is a UK law designed to protect personal data and provide individuals with control over how their data is collected and used.

- What is the connection between data governance and data compliance? Data governance and compliance are closely intertwined. Data governance refers to the overall management of data within an organization, while compliance ensures that this data is managed in line with relevant laws. Together, they ensure that data is secure, accurate, and usable, while reducing regulatory risks.

- How can data governance tools support data compliance? Data governance tools help mitigate the risk of non-compliance by ensuring data is well-managed and compliant with ever-evolving regulations. These tools provide control over data quality, security, and audit readiness.

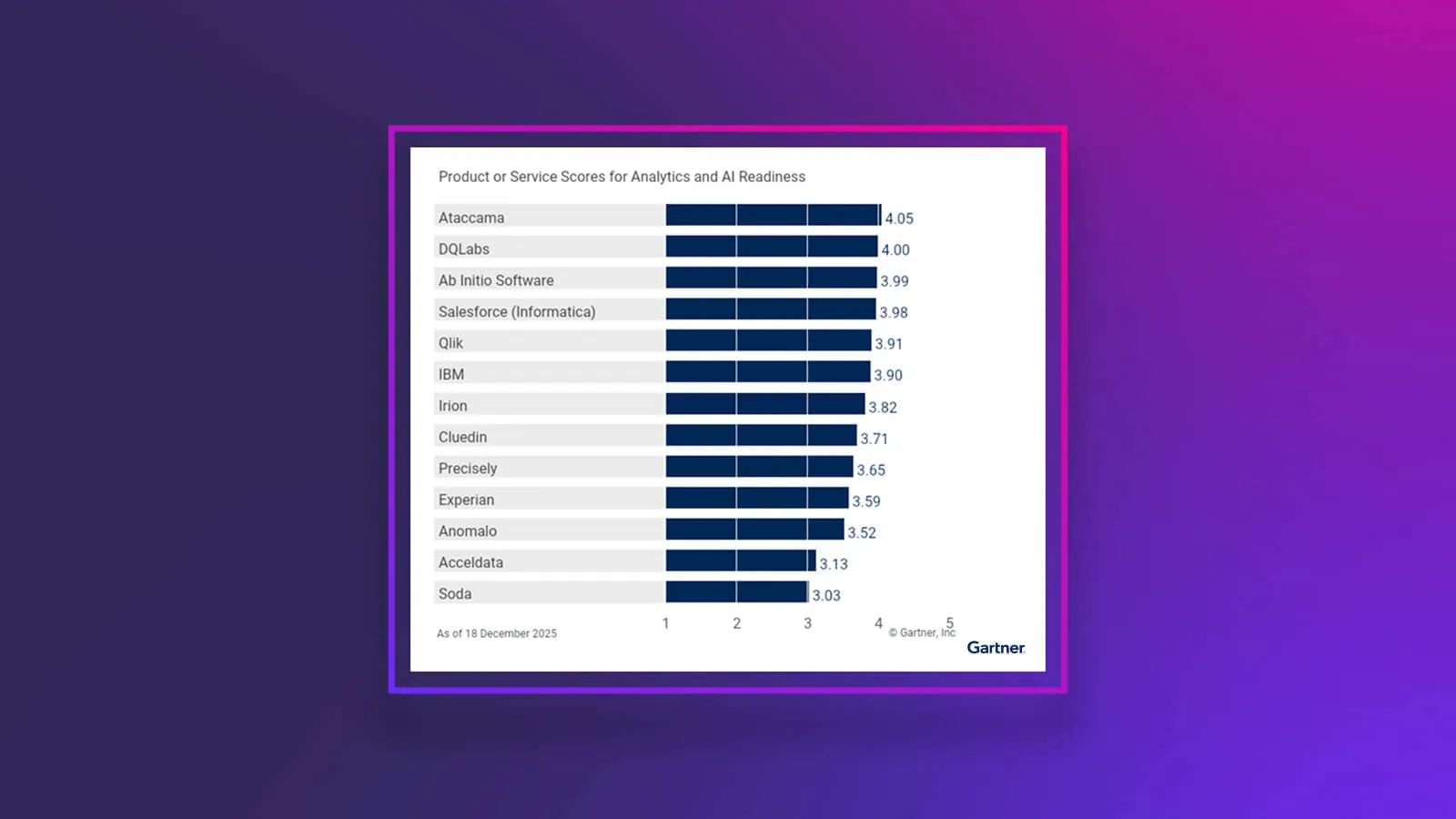

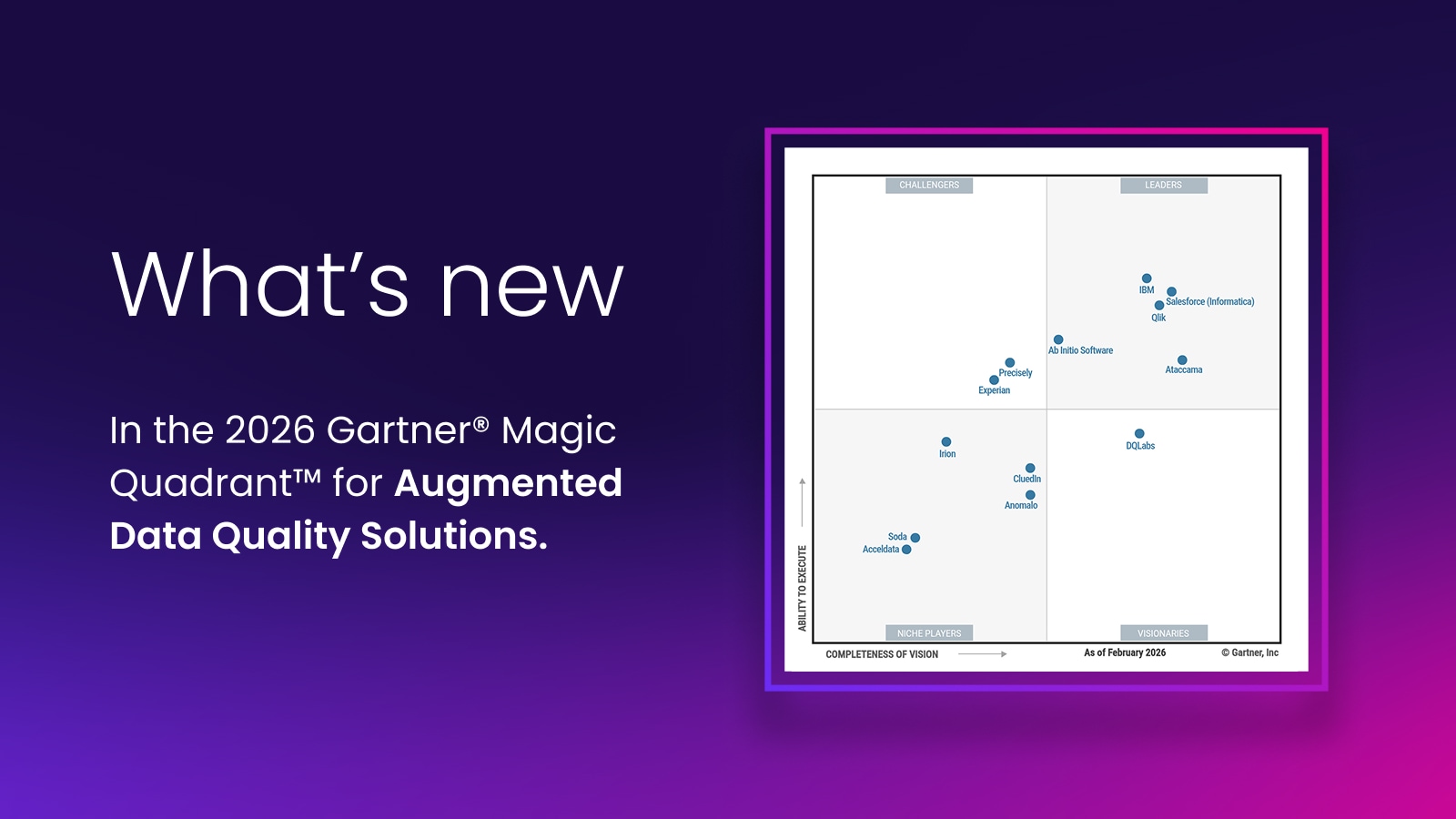

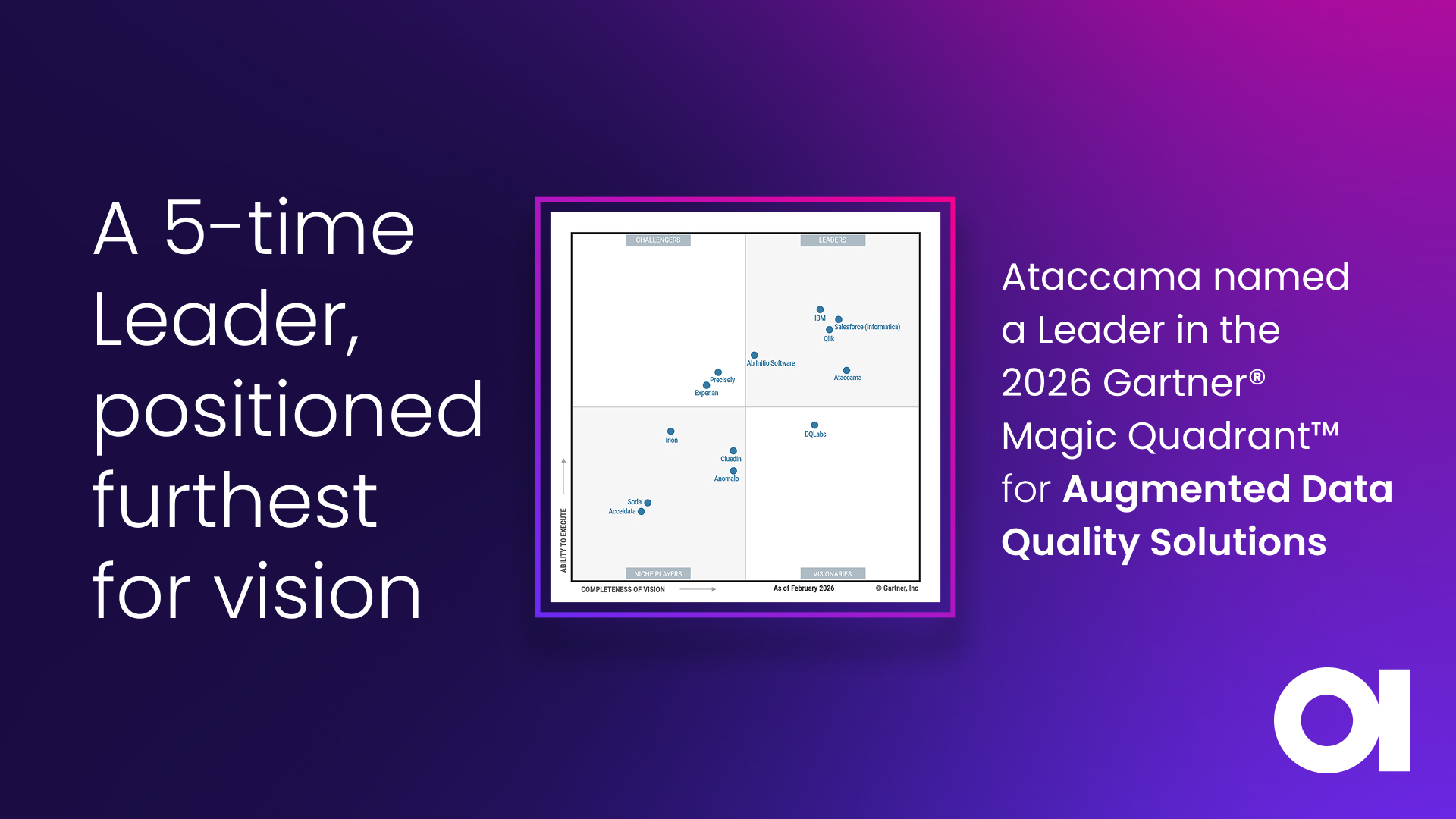

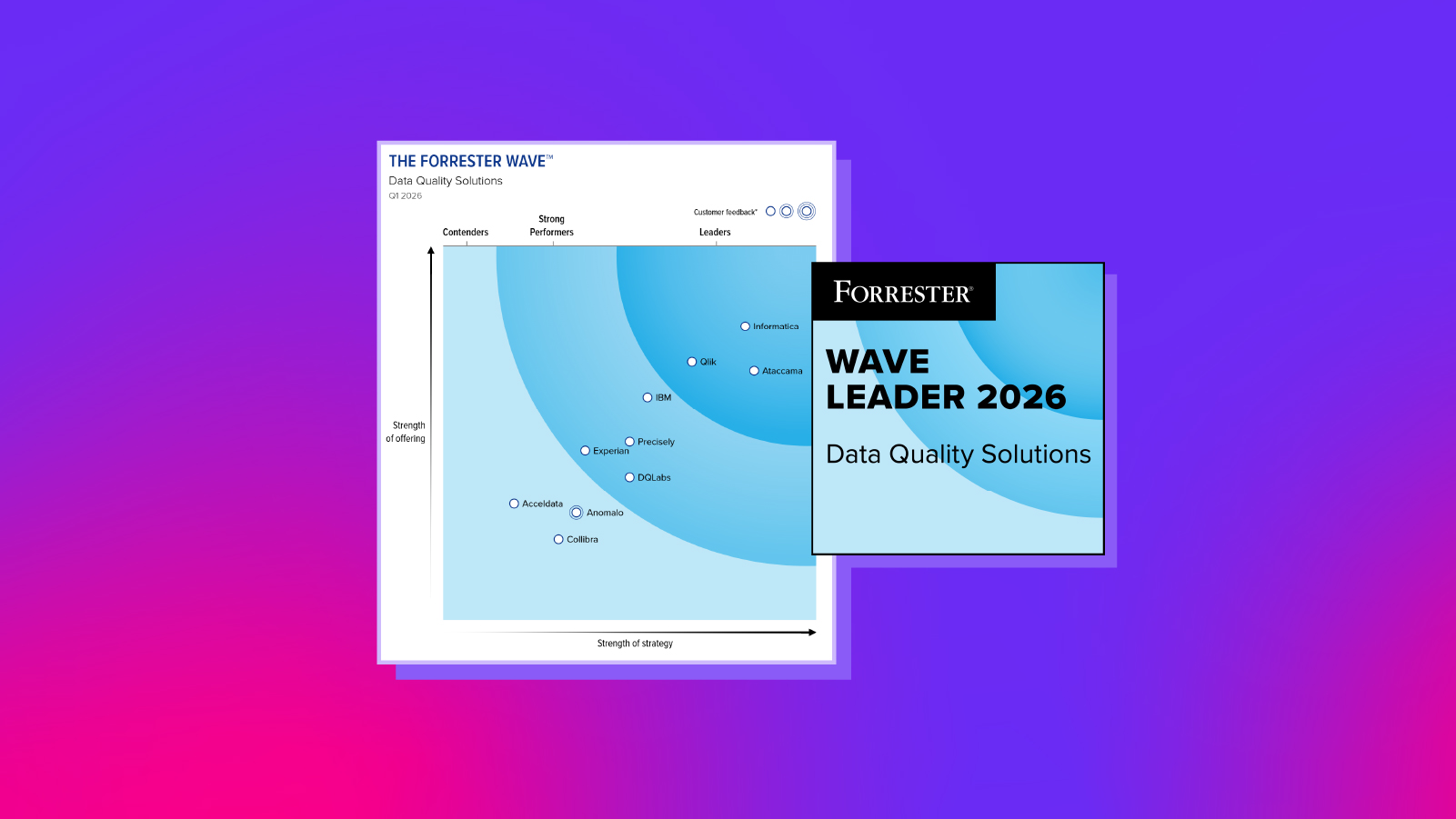

Meet data compliance standards with Ataccama

As data compliance rules keep changing, companies need to stay ahead and make sure they’re following the latest standards. With Ataccama’s data governance software, you can simplify compliance, keep your data intact, and reduce the risk of falling out of line. Explore our Data governance solutions and data catalog software to take control of your data and stay compliant in 2025 and beyond. Ready to improve your data governance and compliance? Reach out to Ataccama today!

Explore more compliance articles:

David Lazar

David is the Head of Digital Marketing at Ataccama, bringing eight years of experience in the data industry, including his time at Instarea, a data monetization company within the Adastra Group. He holds an MSc. from the University of Glasgow and is passionate about technology and helping businesses unlock the full potential of their data.