UK Insurance

Business objectives & project requirements

- Improve data quality to support decision making at all levels of the business.

- Meet or exceed regulatory reporting requirements.

- Determine the relevance of data stored in core systems and remediate any issues.

- Implement tighter, more automated controls for capturing data in order to preserve data quality. Enable data entry monitoring to safeguard the quality of data used in analysis and reporting.

- Cleanse data in anticipation of data migration.

- Track the validity, accuracy, and correctness of data and monitor source system data quality.

Initial data challenges

- Insufficient quality of data being captured and consumed (initially issues with 18% of the company’s data).

- Low confidence in numbers used for analytics and reporting to shareholders and regulators.

Solution & benefits

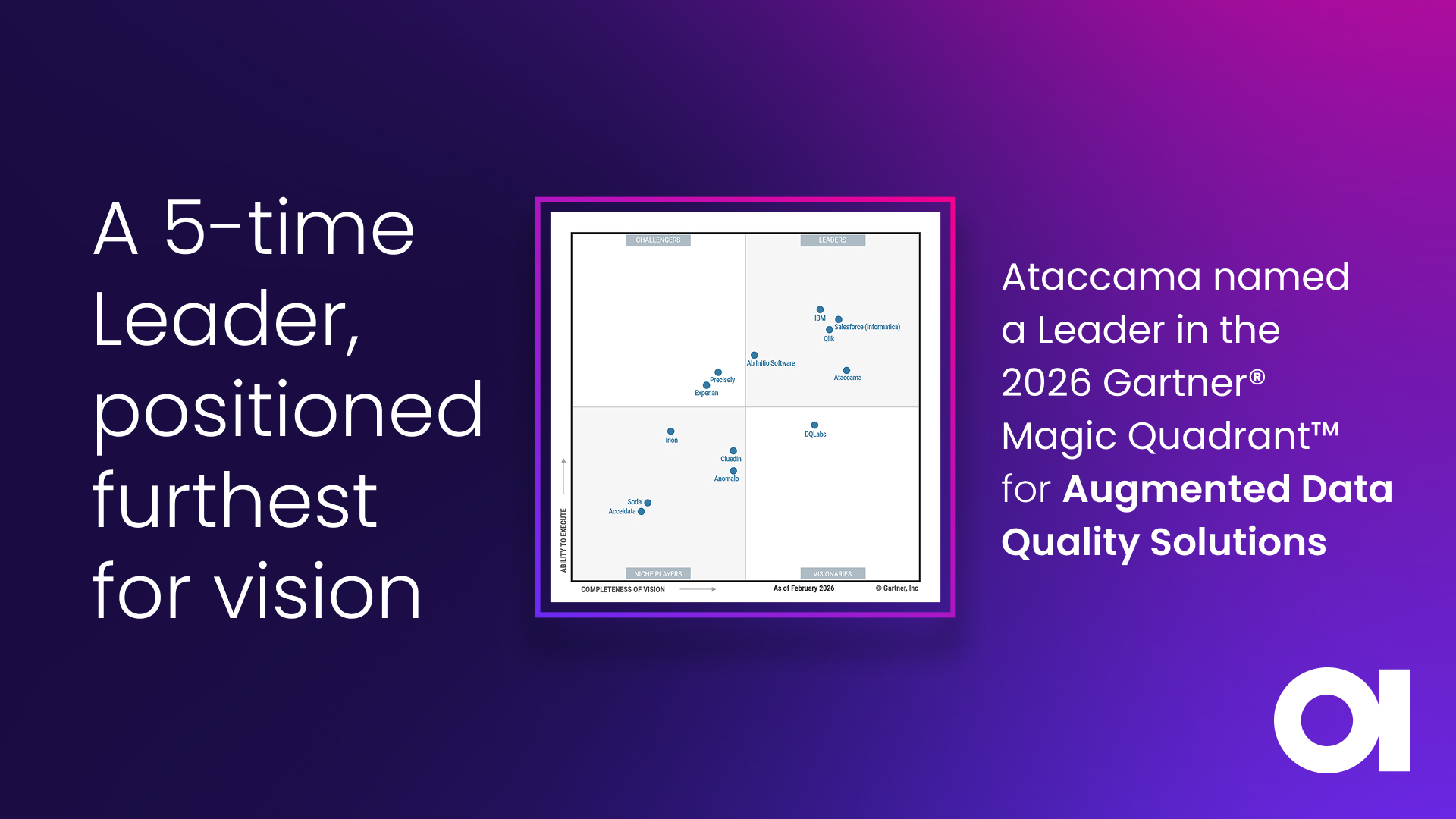

Data quality improvements of up to 99%: Working with tens of thousands of records, Ataccama reduced data quality issues to 1%. This improvement allowed the company to take control of data being used for risk assessment, other internal purposes, and regulatory and shareholder reporting.

Business buy-in: The value of the data quality initiative was recognized not only by IT and data experts in the company, but also by business users and executives.

User-friendly solution: Ataccama’s user-friendly dashboard enabled business users to have a quick view and clear understanding of the contents of their data and issues in need of fixing.

Fast implementation of new rules: In the course of one day, several new rules can be implemented and the results seen immediately.

Business objectives & project requirements

- Improve data quality to support decision making at all levels of the business.

- Meet or exceed regulatory reporting requirements.

- Determine the relevance of data stored in core systems and remediate any issues.

- Implement tighter, more automated controls for capturing data in order to preserve data quality. Enable data entry monitoring to safeguard the quality of data used in analysis and reporting.

- Cleanse data in anticipation of data migration.

- Track the validity, accuracy, and correctness of data and monitor source system data quality.

Initial data challenges

- Insufficient quality of data being captured and consumed (initially issues with 18% of the company’s data).

- Low confidence in numbers used for analytics and reporting to shareholders and regulators.

Solution & benefits

Data quality improvements of up to 99%: Working with tens of thousands of records, Ataccama reduced data quality issues to 1%. This improvement allowed the company to take control of data being used for risk assessment, other internal purposes, and regulatory and shareholder reporting.

Business buy-in: The value of the data quality initiative was recognized not only by IT and data experts in the company, but also by business users and executives.

User-friendly solution: Ataccama’s user-friendly dashboard enabled business users to have a quick view and clear understanding of the contents of their data and issues in need of fixing.

Fast implementation of new rules: In the course of one day, several new rules can be implemented and the results seen immediately.